Wall Street University: Betting Markets (Part III)

Why are there so many opportunities on PredictIt? The rules and mechanics of political betting markets.

This is Part III in an eight-part series on PredictIt betting markets, trading models and Portfolio Theory.

This chapter covers the mechanics of PredictIt betting markets and why there are so many opportunities for profit.

This Series

Part II: Building Blocks & Covariance

Part III: PredictIt & The Mechanics of Markets

Part IV: The Best Bets (Statistically) & Two-Bet Portfolios

Part V: Optimal Portfolios & The Efficient Frontier

Part VI: Polling Models, Internal Models & Large Portfolios > $20,000

Part VII: The Math, The Code & Visualizing 10,000-Dimensional Spaces

Part VIII: 2018 Elections & Becoming a Portfolio Manager

About PredictIt

PredictIt.org is a US-compliant “Prediction Market” run by the not-for-profit Victoria University of Wellington, New Zealand.

PredictIt offers markets for various events politics, elections and the economy. Although there are world markets, PredictIt’s main focus is on US politics.

Unlike many betting sites, PredictIt is a US compliant exchange with a clean interface and professional support. Unlike it’s shady off-shore counterparts, it is easy to withdraw funds and even prepares Form 1099 tax documents at year end.

PredictIt charges a 10% fee on any profits made in the market. Additionally there is a 5% fee to withdraw funds. Part IV discusses these topics in greater detail.

PredictIt remains compliant with the Commodities Futures Trading Commission (CFTC) by limiting bet sizes. A single participant cannot wager more than $850 on any individual market, which has the effect of making PredictIt somewhat inefficient, providing excellent betting opportunities.

Because of the limits in place, a large institutional trader cannot consume all of the opportunity in a market. As a result, the markets have more democratic or voting-price mechanisms than traditional capital markets.

How Markets Work

Before getting into the details, let’s take a moment to discuss the mechanics of PredictIt’s website.

A typical market will define a specific binary event on which you can bet (“Buy Yes” or “Buy No”).

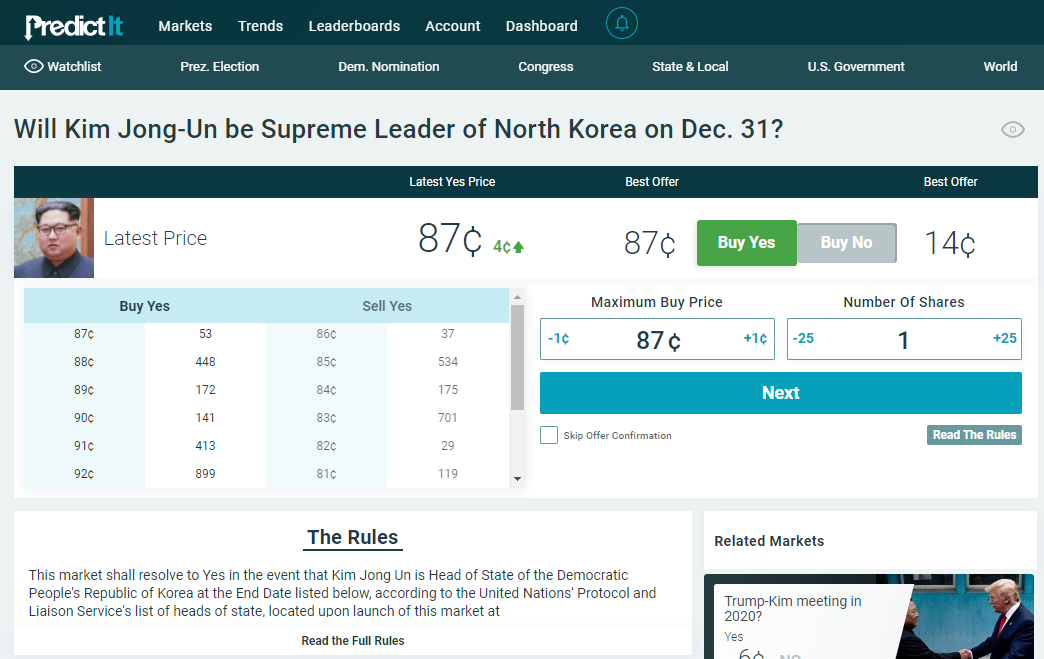

Here’s a market asking if Kim Jong-Un will be the leader of North Korea on Dec 31.

If you were to “Buy Yes”, you would be betting that Kim retaining power through Dec 31 has a probability greater than 87%. You would risk $0.87 to win $1.00 in the hope that it settles in the affirmative.

In many markets you may wish to sell (bet against) the outcome. Unfortunately, PredictIt does not offer a simple “Sell Yes” option. Instead they use the convoluted, but materially identical, “Buy No.”

When you “Buy No” you are also purchasing a contract, but one that settles at $1.00 if the stated market settles to “No.”

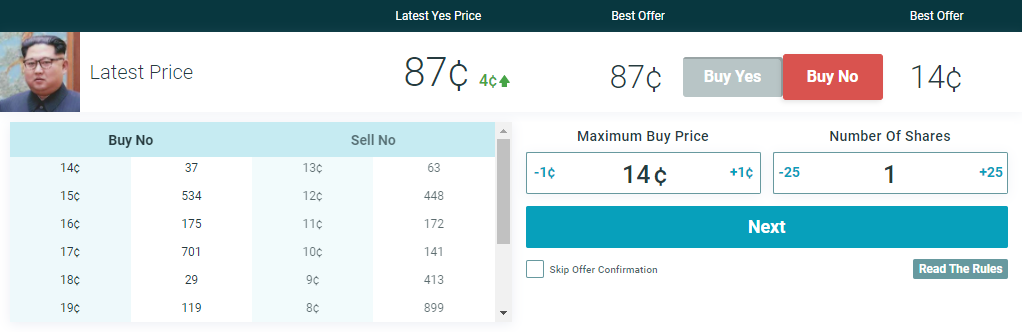

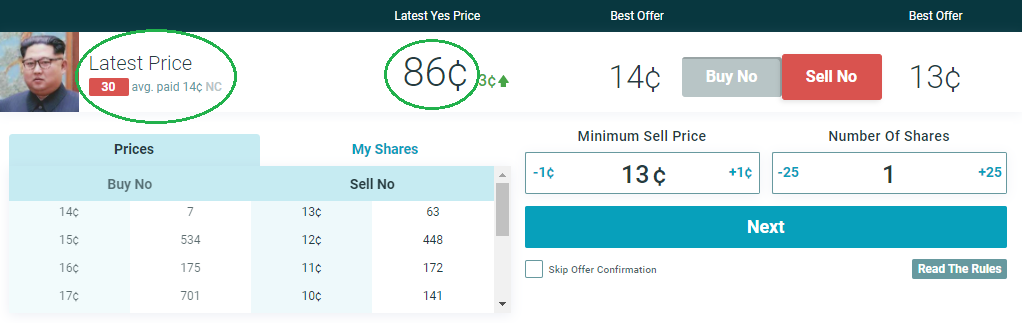

Here, the same market which was 86/87 for “Yes” is 13/14 for “No.” If I wanted to “Buy No” at $0.14 it would be materially the same as selling “Yes” in the previous example.

Additionally, if I had previously purchased “Yes” shares, to exit the position and bet the opposite way, I would first “Sell Yes” shares until flat (You can Sell Yes if you are long it). Then I would “Buy No” share to enter the opposite position. These are all the same two actions, but needlessly expressed as four distinct terms.

Another annoying design feature: the price and price change will still be quoted from the “Yes” contract, but your entry price will be inverted to the “No” price.

Is your head spinning yet? Don’t feel bad if it is. It just has a few poor design choices, but it’s not as complicated as it sounds

Once you get used to the two or three small annoyances, the rest of the PredictIt interface is actually quite user-friendly. They even have a functional API.

Fees & Withdrawal

PredictIt assesses a fee of 10% of any profit from winning shares. This can be a share that has settled as a win or a share that is sold at a profit. In either case, the fee is 10% on the profit you make. Later, you will see how this produces some strange prices in markets (ranging from $0.91 to $1.22). You will also find several opportunities for trading due to this fee structure.

While there is a 5% fee on any capital that is withdrawn from PredictIt, there are no fees on deposits. Accordingly, it would be to deposit money you plan on keeping on PredictIt for a substantive duration of time. All the funds I currently have on PredictIt are left over from 2018, when I was betting on the midterm election. I prefer to keep my funds in PredictIt and achieve a 5–15% return by betting on random, mispriced markets until the following election year.

For example, I bet on Brazilian President Bolsanaro at 85% when he was essentially guaranteed the run-off election win. There are always a few markets like this that you can utilize during off-election years.

Multiple-Contract Markets

Some markets do not have binary outcomes. Here, a market is broken into several mutually exclusive events and each is treated as a binary Yes/No market.

91–110 Markets

One of the consequences of the 10% fee on profits is that multiple-contract markets, which cover all possible events, will total to a price other than 100 — typically greater than 100.

However, something that appears to be a discrepancy cannot be arbitraged. For example, if all the contracts in a market summed to 105 and you purchased “No” on all contracts to lock-in 5% profit, the fee on your profit would result in a net loss.

For example, if the market has 7 mutual exclusive events all priced at $0.15, this sums to $1.05. Assuming you sold short all 7 markets, you would ultimately loss $0.85 on 1 market (the winning market) and profit $0.15 on the 6 remaining markets. In the absence of fees, this would net to a gain of $0.05 = 0.15 x 6 - 0.85.

When fees are considered, you would pay 10% of each of the winning markets, but there is no netting of losses. Therefore, the final profit equals 0.15 * 6 * 0.9 - 0.85 = a loss of $0.04.

Therefore, markets can actually add up to values as extreme as 91 and 110 before a true arbitrage forms.

Since most mispricing is driven by demand for new positions, markets are almost always over 100 in aggregate. In practice, I’ve seen totals as high as 121. Here, an arbitrageur would receive a 10–11% return.

But on PredictIt that is often not a sufficiently attractive opportunity!

Taxes

PredictIt is fully US compliant, including issuing Form 1099 for any person that profits over $600 in a calendar year.

For more information here are the full details on PredictIt markets: How to Trade on PredictIt.

The Five Opportunities

Now that we’ve got the housekeeping topics out of the way, let’s dive into the good stuff.

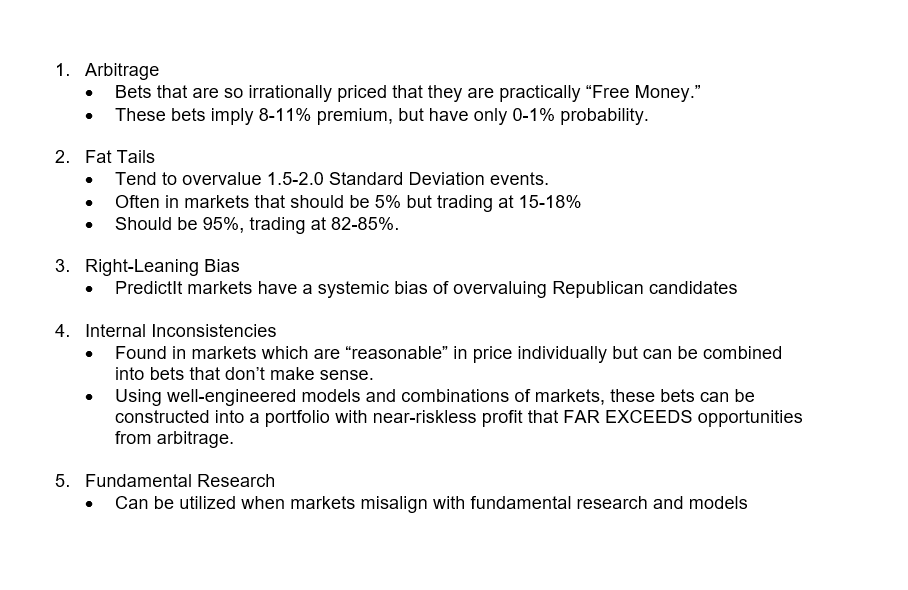

The opportunities profit on PredictIt generally fall into to five categories:

This series focuses on #4 and #5, though elements of all five aid in our strategy.

The $850 limit

Where do these opportunities come from?

Group 1 & 2 are unintended consequences of the $850 limit.

The maximum bet on any market is limited to an $850 loss, but there is no limit on the number of shares. Therefore, if a market is at 95% for “Yes,” a single market participant can buy a maximum of 894 “Yes” shares or 17,000 “No” shares.

Such imbalances of market impact have the effect of inflating the price of low probabilities events (Groups 1 & 2).

Groups 4 & 5

The internal inconsistencies are a natural outcome of complex markets. Few market participants are sophisticated enough to consider and compute the various combinations of markets and implied conditional events. The time investment, study and computational investment are just not worth it for most bettors.

This series exists to pull back the curtain a bit on complex Wall Street models, Portfolio Theory and hedging.

Variety of Markets

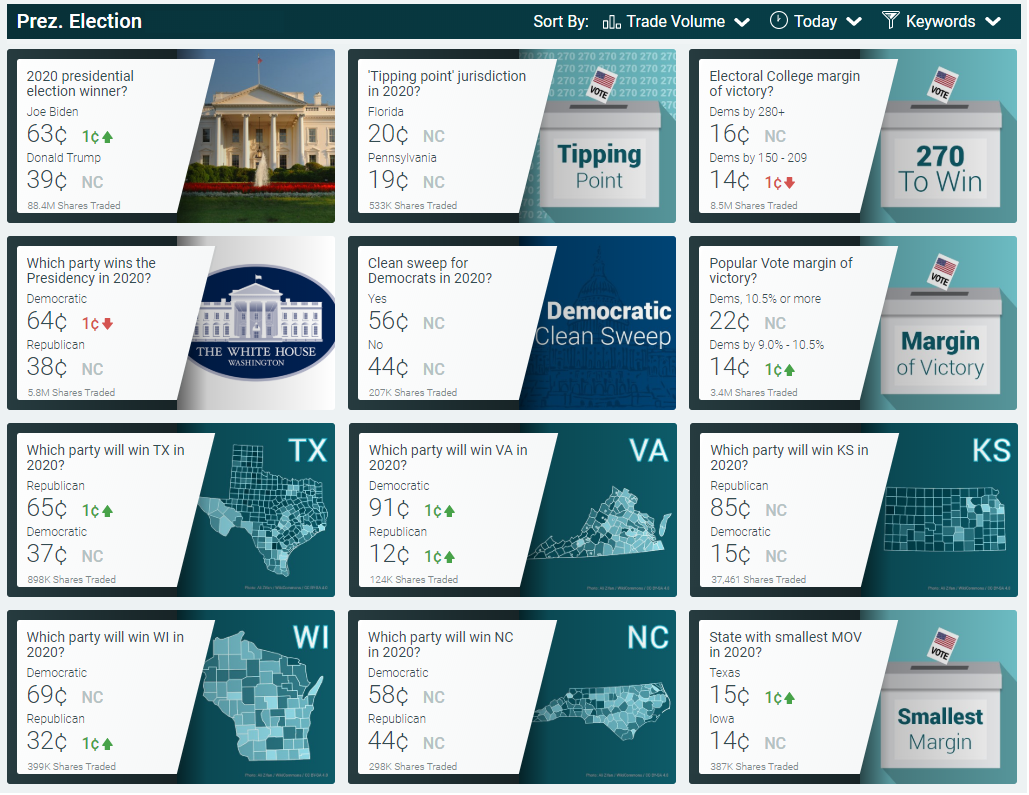

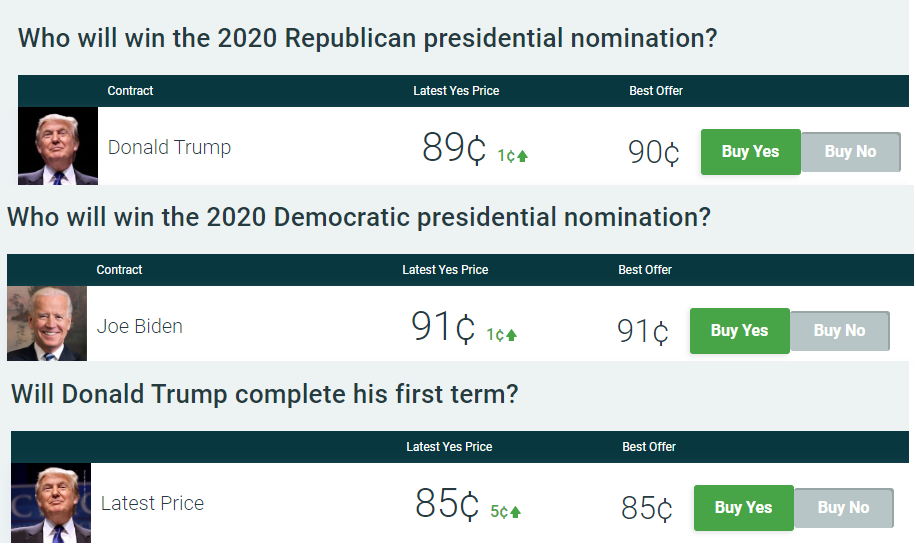

PredictIt offers many different bets on the Presidential Election (260 in total).

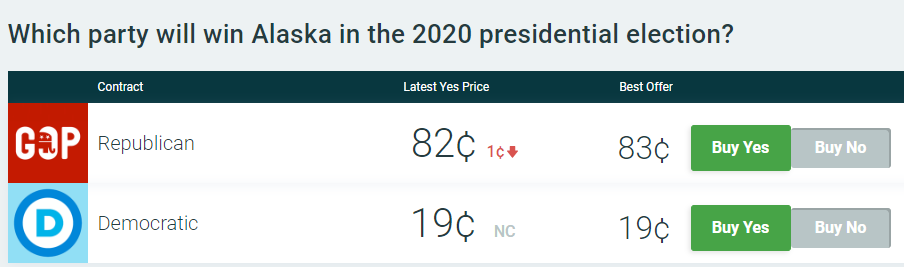

Some markets are high-level, such as presidential winner or popular vote winner. There are markets for individual states and one market for each of the 56 electoral units (50 states, DC, NE 1–3, ME 1–2). These markets are mostly straightforward, ignoring the complexities such as Faithless Electors.

Other markets are a parlay, or bespoke combination of outcomes. Examples include “Trump to win any state he lost in 2016?” or “Electoral winner wins popular vote?”.

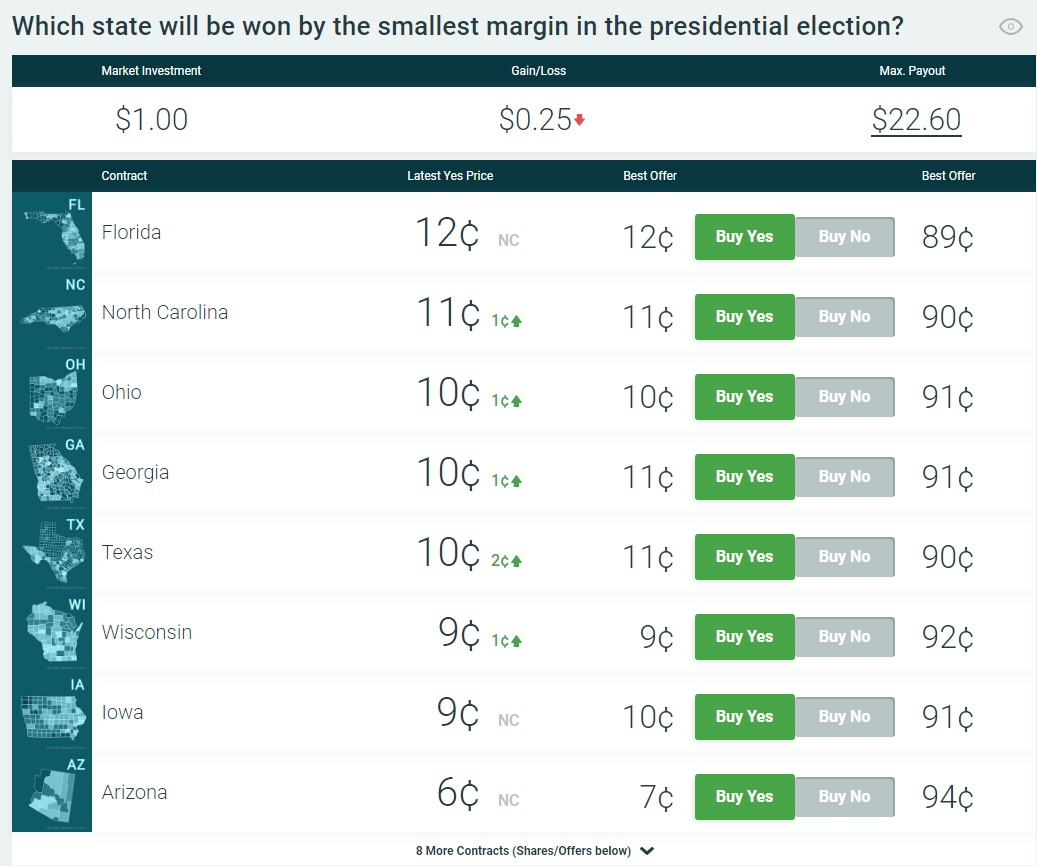

Some markets seek to find the inflection point between the Blue states and Red states. The market “Smallest margin-of-vote state?” is very similar in principle to “Electoral margin?”. “Tipping point state?” is a probability bet on the swing-states and their electoral sizes.

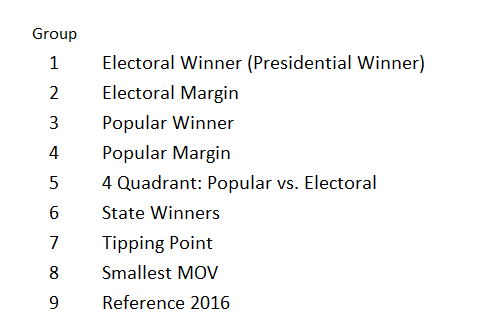

To classify the 260 a bit, I organized them into 9 categories.

These 260 markets have clear rules and dependencies which make a rainbow of correlations from -100 to +100.

Next we discuss the best opportunities and begin understanding risk and hedging.

Part IV: The Best Bets (Statistically) & Two-Bet Portfolios

Collaboration

For any interesting projects or research, or if you just want to discuss some topic, please reach me at: nickyoder10@gmail.com

Don't forget to sign up for weekly updates to the model, polls and optimal Bets! As market prices change, public polls change and the time until election decreases, I'll update these every week.